Imagine If You Will

Imagine if you will, a world where the card you apply for, the credit that you thought you had and the points you believed you were accumulating, were not utilized in a transaction, even though you tendered that very card to the merchant.

The Mandela Phenomenon

Imagine instead, the merchant chose to route your credit card transaction on a competing network. One where the dispute resolution process differed from the one you believed you were purchasing the product under. You protest for a moment, imploring the merchant to route the transaction over your preferred network. After all, this was a significant purchase and you specifically placed the purchase on a specific credit card because you had concerns that the merchant may not be able to accommodate the purchase and you wished to reserve your right to dispute the item if the purchase did not meet the merchant’s claim.

Instead, the transaction is routed to an alternative credit card network. Your dispute rights are questionable. Your credit score is impacted because even though you did not intend to increase the size of an outstanding loan, the merchant routed the transaction over a network which decremented a lender with which you had an existing relationship. To compensate you for the loss of points, the merchant gave you points towards a gym membership (which you find completely useless).

You’re No Jack Kennedy

This world which you found yourself in could be our future. Senators Durbin and Marshall have introduced a Bill[1], which would direct the Federal Reserve to ensure that giant credit card-issuing banks offer a choice of at least two networks over which an electronic credit transaction may be processed.

Effectively, if you had a Visa or Mastercard, the card would need an alternate choice not named Visa or Mastercard. Unlike the original Durbin from 2010, which required two unaffiliated debit networks to be available for each debit card transaction, this Bill applies to credit transactions. This means the consumer is accessing a credit product, not their own funds and such draw is predicated upon the approval and all the regulatory constraints which surround consumer lending. Second, credit transactions are dual message transactions requiring a settlement routing after the authorization. With dual message transactions, Interchange is not known at the time of the authorization so least cost routing can be even more complex.

Read my lips, “No Blue Taxes”

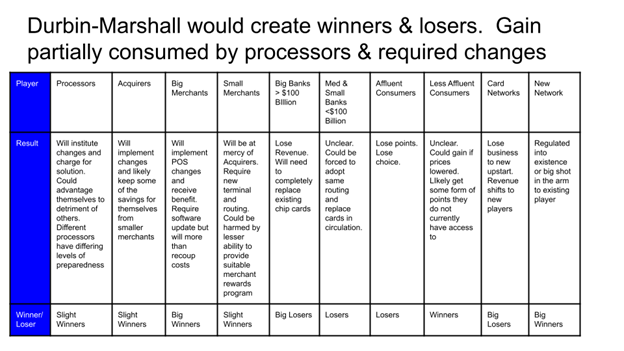

If passed, this Bill would be an enormous tax on the system. There will certainly be winners and losers but the net loss dwarfs the net gain. The only question is: Who are the winners and losers and what is the tax? This will be an enormous benefit to chip manufacturers and smaller card networks such as American Express, Discover and the Debit Networks. We could rename the Bill, the Full Employment Act for Chip and Manufacturers and the Consultants who certify devices and software. Processors will have an enormous road map just to ensure compliance. On the bright side, they will charge for compliance. Looking at winners and losers:

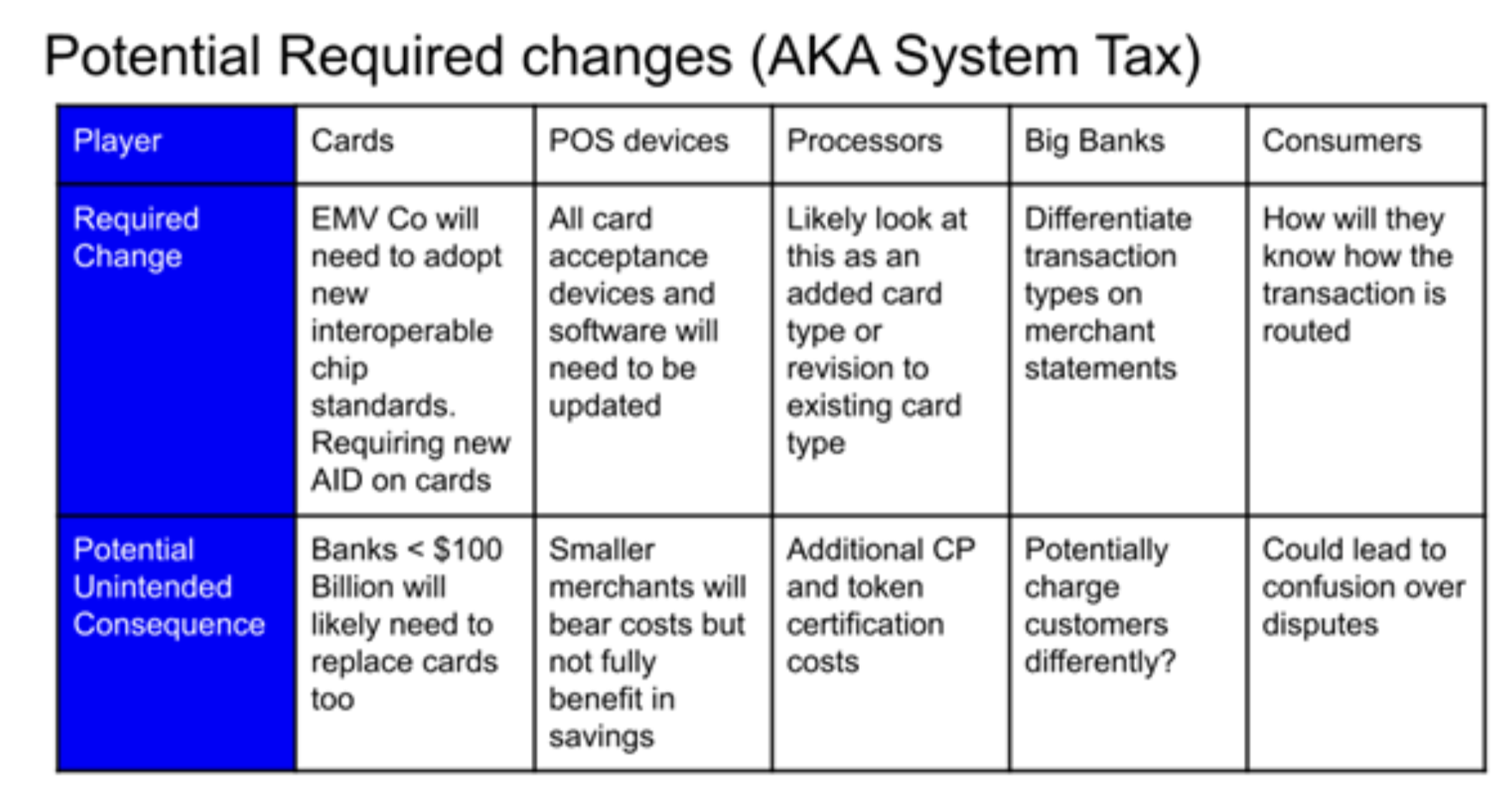

Regardless of the winners and losers, the overall gain will be muted by the system change required. This will create a tax on the entire system:

The biggest winner will be the “New Network”. This need not be a new network so much as something other than Visa or Mastercard. American Express, Discover, PayPal, Square or the debit networks could be enormous beneficiaries of this Bill. My take is this Bill is meant to lessen the reach and dominance of Visa and Mastercard but this is akin to traveling around the world to visit next door.

Where did all the Alligators come from?

Smaller financial institutions, under $100 Billion, may be unintentionally harmed because less affluent customers elect to migrate to a large bank that has the alternate network. If a less affluent client, with a credit union is not able to take advantage of a ‘large-box merchant points program’ because their card is not enabled for such, either the credit union needs to modify its system or the consumer will flee to a large bank.

Large banks may selectively and adversely classify these transactions OR they may be routed over another lender entirely.

Potential alternatives could emerge too where the transaction is approved by Visa or Mastercard but settled by a third party. Think of a Visa approval settling over FedNow. Large merchants already have their own loyalty programs so they can quickly encourage smaller networks to participate in their loyalty program, but this will disadvantage smaller retailers who either pay a higher transaction processing fee or offer what is surely to be a lesser loyalty program.

I’ve read arguments which are against this Bill because of lack of security in alternative networks and the potential violation of consumer’s privacy. Both of those arguments are without merit. Visa and Mastercard are not more secure because of their heft. They are likely less so. Moreover, every big merchant today tracks consumer purchases down to the SKU level, by customer. This Bill will weaken neither security nor privacy. This does not imply, however, that this Bill is well thought.

Ask me how I really feel…..

If the Bill’s authors wanted to weaken big banks’ and Visa and Mastercard, there are more direct ways to do so, starting with price controls on Interchange. Another alternative is to limit their size to their current state and let other players catch up. Alternatively, we could employ a tax on any card network over a certain size or offer a tax credit to any smaller network. Heck, we could expedite tax refunds by posting those exclusively through Discover or a debit network. I’m not advocating for any single plan, but pointing out that this plan, where there is gigantic system change needed, negative impact to consumers and questionable benefit to small merchants; is about as bad of an idea as I could possibly conceive.

[1] Durbin, Marshall Introduce Bipartisan Credit Card Competition Act

Author: Ken Musante, Commercial Director, San Francisco, Payments Consulting Network

Ken has over 30 years of industry experience and connections within the U.S. Payments industry. He has a deep understanding of the infrastructure and pricing supporting the payments industry—specifically the technology, financial institutions, card brands, processors and vendors.

***

Payments Consulting Network is one of the media partners of MRC Vegas, the leading conference for payments and fraud prevention industry professionals.

***

If you enjoyed reading this article and would like to be notified when future articles are posted, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass on the top right-hand side of the website, and type in the keywords that interest you. You will then be presented with a list of any articles that match your search criteria.