The D of Cross Border Payments

De-Dollarisation is here. It is going to pose an interesting choice for all participants in the payments chain. Most importantly, the channels will need to be prepared to offer an assortment of very different currency pairs than what legacy systems currently offer. Importantly, they will need to meet the regulatory requirements to satisfy, price and settle these payments. With the coming of the latest fintech revolution, this delivery will be via the digital route.

De-Dollarisation is here. It is going to pose an interesting choice for all participants in the payments chain. Most importantly, the channels will need to be prepared to offer an assortment of very different currency pairs than what legacy systems currently offer. Importantly, they will need to meet the regulatory requirements to satisfy, price and settle these payments. With the coming of the latest fintech revolution, this delivery will be via the digital route.

Clearly automation required will be for customers and institutions to be able to deal and settle in very different currency pairs where both currencies could be regulated. E.g. RMB/BDT, INR/VND. Especially as intra-Asia trade increases (ASEAN, South Asia, Greater China corridors) – esp. with the diversification of the supply chain (and this is equally applicable to Africa and LATAM as well). Add to this, the advances in technology and the readiness to adopt B2B partnerships to meet the automation requirements, improve customer experience, and meet evolving demands.

Decades of deepening global economic integration, hastened by advances in logistics plus the aim to lower manufacturing and automation or labour costs, has allowed for a world to be more interconnected and interdependent. However, with the recent geopolitical events, the world is becoming multi-polar, and we are seeing the impetus for change to the old order. As the world’s reserve currency, the US dollar is essentially the default currency in international trade and a global unit of account. Because of that, every central bank, treasury or exchequer, and major firms keep a portion of their foreign exchange holdings in US dollars. As the holders of dollars seek returns on those balances, it helped the demand for US government bonds in world financial markets.

But changes are afoot. Here are some examples highlighting the shifts in the landscape:

- China and Brazil recently reached an agreement to settle bilateral trades in their respective currencies. During the last 15 years, China’s ascendance as the primary trading partner of resource-rich Brazil has displaced the United States. This shift could be regarded as inevitable.

- India and Malaysia have recently declared their usage of the Indian Rupee to settle specific trades through a distinctive Rupee vostro account. Furthermore, this privilege has been granted to an additional 17 countries.

- China has also recently conducted a trial trade for natural gas with France, settled in yuan.

- The yuan is currently the most used currency for trading in Russia.

- Chicago’s CME Group opened options trading for Chinese yuan futures in response to the increased demand for the currency.

- Bangladesh and Russia have agreed to use the Chinese yuan for loan repayment related to the Rooppur Nuclear Power Plant project.

There have been perennial warnings about Saudi Arabia and other energy exporters also looking to offer pricing in other currencies. This shift in strategy is accompanied by changes in buying patterns at the retail level, with eCommerce and travel sites offering pricing and purchasing options to end clients in multiple currencies. And this trend will only accelerate when you look at the many other industries that could benefit from this like insurance and logistics.

Source: Share of World Currencies Over the Years (Swift Messages MT 103 and MT 202) – source IMF article WP/23/72 by Hector Perez-Saiz, Longmei Zhang, and Roshan Iyer.

These moves, when compounded with geopolitical complications, could deal a blow to the central role of the dollar in global trade. It will accelerate a shift into a multipolar or more fragmented international monetary system. Interestingly, when geopolitics becomes a factor in economic decision-making, countries can go to great lengths to protect their national or economic security. With concerns about energy security, food security, problems faced by the global supply chains, and securing minerals for the energy transition coming to the forefront, countries seem to be increasingly willing to manage these risks through protectionist policies. One such measure is to establish bilateral payment and settlement arrangements.

The shift in economic power towards emerging and developing economies has intensified the need for change. Emerging markets now account for a much larger share of global population and supply of primary commodities, a growing share of global GDP, as well as the manufacturing industry. China alone accounts for roughly one-third of global manufacturing value added. Although trade and foreign direct investment (FDI) patterns have reflected these economic shifts, the global order governing these transactions and settlements has not kept pace and will need to adapt. We will see more non-traditional currencies used to price and settle deals alongside their integration into the payment channels employed for these transactions.

However, simply replacing the US dollar with these other currencies is not that easy. Moving away from the dollar brings substantial nuances to tackle including addressing complex nuances and modifying legacy architecture and correspondent networks. The US dollar serves as the de facto currency for a lot of the smaller markets and no less than 22 foreign central banks and currency boards pegging their currencies to it. An interesting observation has been the recent increase in gold prices and demand. If the perception about the dollar losing its reserve currency status persists, then it would be ideal to observe how gold reacts to the market status and uncertainty.

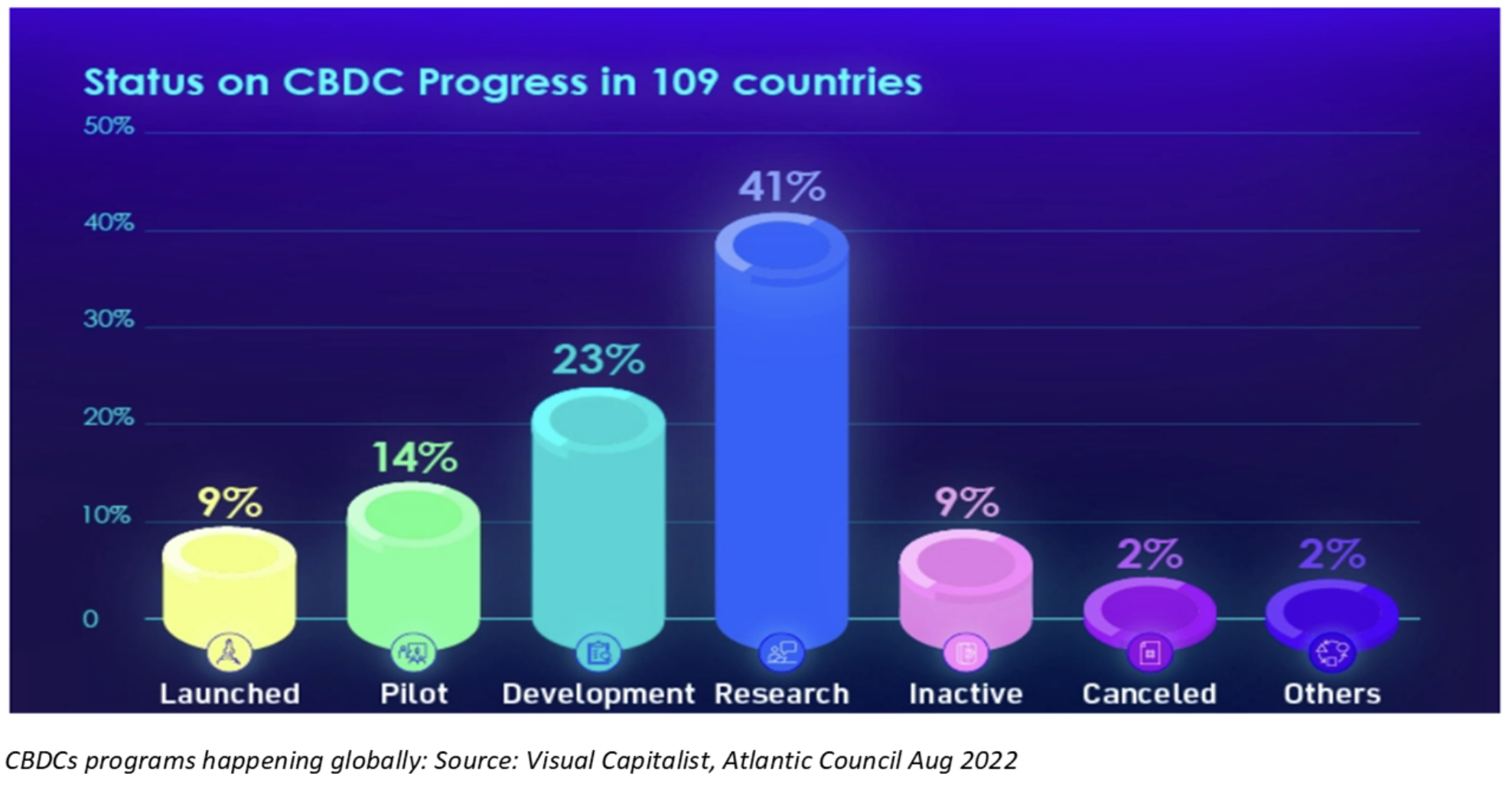

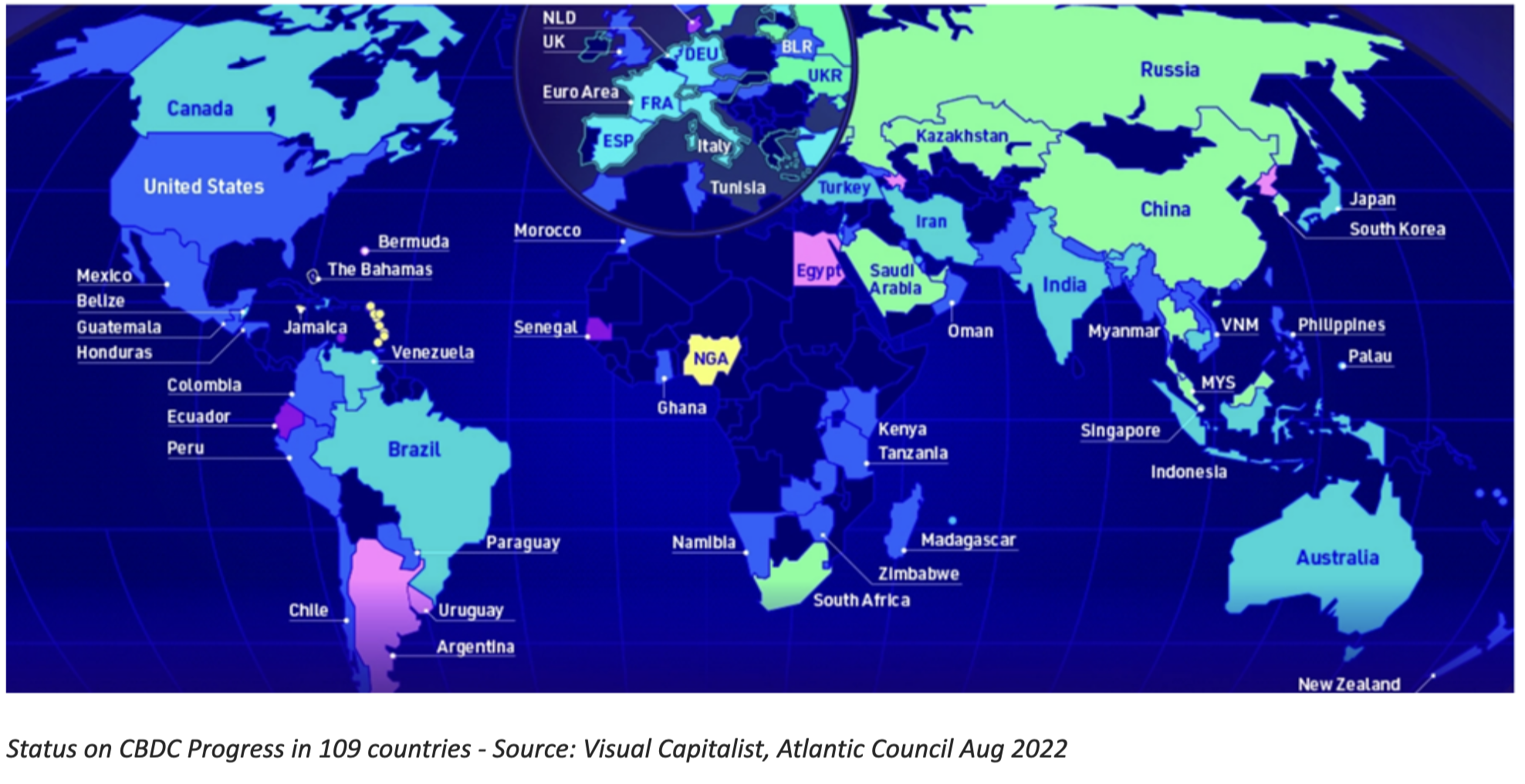

Which is why another D – digital – could answer some of the challenges above and accelerate the change. Using digital solutions and propositions becomes essential as banks and institutions re-position their propositions/costs to meet the evolving customer experience (CX) which allows for a departure from legacy architecture. A key digital component to the De-Dollarisation will be Central Bank Digital Currencies (CBDCs). While debates on data access may arise, to me, having CBDCs override the goals set out for financial inclusion, cost reduction on transfers (domestic and cross border), and most importantly, a tool that governments can control via inclusion in the monetary policy. Both retail and even corporate users will have the confidence to use them. Unlike other forms of digital payments, like digital wallets and cryptocurrencies, CBDCs represent a direct claim on the central bank and are digital forms of fiat currency. As things stand, the status for testing and usage is:

Previous attempts at disruption were hampered by the legacy systems/architecture and the fear of losing revenue. That is now being consigned to the bin as the reality hits home – change or perish. And this shift is not just aimed at the B2C retail space alone. B2B & DeFi partnerships have become imperative to banks and companies realising that they no longer need to make significant capital expenditures. Through smarter partnerships, more sophisticated technology, and above all, recognition that “a one size fits all” no longer works, everyone needs to now embrace these B2B partnerships to cater to a more diverse yet important set of clients and their needs. What is needed now is to arrive at a standardised process that allows adoption. Additionally, what makes this an even more attractive proposition is that countries/markets without an established payments eco-system can also leverage on this to digitise/automate their economies.

The potential disruption in the payments industry from tokenisation and crypto must be considered. Crypto has – rightly so – attracted a fair bit of negative attention, and perhaps considering it as an asset investment negated the benefits that it does bring to the table in the payments world. The lack of standardisation and better ways to manage and hedge the risks remain a challenge. The reality though is that RFPs have started mentioning the need to collect them in the client accounts/wallets. With the introduction of tokenisation, digital assets will play a significant role in the new world architecture, accompanied by disruption from established wallet players who are seeking to expand the scope of their existing product offerings. It is important for companies and business leaders to stay agile with emerging financial trends and shifts. There are also expert providers such as Finsight Global Consulting Limited that offer advice and support to help businesses navigate the changes in the payments industry and cross-border payment roles.

Author: Rajat Mehta, Managing Partner, Hong Kong & Vivek Deshpande, Managing Partner, Hong Kong, Payments Consulting Network

Rajat Mehta and Vivek Deshpande together have almost 60 years of experience and possess domain expertise in Corporate and Transaction Banking, Treasury Services, Foreign Exchange and Global Markets, Risk Management, and Cash Management. They have also established Finsight Global Consulting Limited headquartered in Hong Kong which offers operational and strategic advisory services to banks, companies, regulators, and different industry bodies.

***

If you find this article helpful and would be interested in reading similar articles, please subscribe to our newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass in the top right hand side of the website, and type in the keywords that interest you. You will then be presented with a list of any articles that match your search criteria.