Payments in real time

Real time payments (RTP) are initiated and settled instantaneously—well, very nearly so—24/7/365. The most common use case for RTP is peer to peer (P2P), but demand has been increasing within the gig economy. Uber drivers, for example, may be paid in real time. Most merchants and acquirers have not considered RTP. There was neither demand nor supply. But with the personalisation of merchant accounts where payfacs serve smaller merchants, such as hair dressers and artists, the need (demand) and competitive pressure (supply) will increase.

Same Day ACH versus RTP

How acquirers address that need will have ramifications on their risk controls and cost of funds. Today, merchants are paid via ACH. This is a batch process and although Same Day ACH is faster (and more expensive) than normal merchant ACH funding, it is not RTP. Same Day ACH follows the same path as standard transactions. Payments are routed through The Federal Reserve, which acts as the Clearing House for ACH transactions; however, Same Day ACH transactions are coded differently.

Same Day ACH may be either a credit or a debit, and the transaction is not authorised and consequently may be returned. Real-time payments, on the other hand, are irrefutable, instant and allow for bilateral communication between the sender and receiver. RTP also connect the payment with payment data in a single transaction. RTP introduce a new clearinghouse, protocols and capabilities, and, as SpiderMan’s Uncle will attest, “With great power comes great responsibility.”

RTP growth

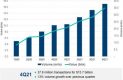

The RTP network from The Clearing House was launched in 2017, is a real-time payments platform that all federally insured U.S. depository institutions are eligible to access. The Clearing House may be accessed directly or through third-party service providers. The Clearing House produced the graph accompanying this article that indicates RTP quarterly growth and usage:

To reduce fraud, the service is meant for credits or payments only where the entity making the payment instructs its financial institution to initiate payment. So, while there is no authorisation required, the payment is irrevocable. Costs are a fraction of the cost of bank wires, and while there is no volume discount, there would be operational efficiencies for large shops. Pricing for The Clearing House may be found here. Like with the card networks, a set of rules governs The Clearing House RTP transactions. There are also limits on the size of individual transactions.

FedNow option

Because The Clearing House is owned by the largest commercial banks, there has been, understandably, concern over the power those large institutions might yield. Consequently, the Federal Reserve is launching FedNow as an alternative to the Clearing House’s solution.

FedNow is expected to be live by 2023. Initially, FedNow and The Clearing House solutions are not expected to be interoperable; however, that is the ideal state.

The RTP alternative

The card networks entered the P2P payment space with Mastercard Send and Visa Direct. Both solutions reverse the settlement process and allow funds to be pushed to an eligible card. While the funds will be available on the card within seconds, they may not be truly a real-time payment, as the funds will not always be available for immediate withdrawal. This does not diminish their value as an alternative, but they should be differentiated from RTP.

What’s in it for acquirers

Historically, acquirers have benefitted from the float as follows:

- Day 0: Transaction processed

- Day 1: Acquirer receives settlement

- Day 2: Merchant paid

This allowed the acquirer to always have at least one day’s deposit on hand. This was important as, in the context of pass-through pricing, acquirers pay the merchant the full amount of their deposits and collect their discount and interchange at month-end.

With the transition to next-day payout, the acquirers float was reduced, as they were essentially paying out to the merchant what they were collecting and not benefiting from the one day hold on funds. Should acquirers move to RTP, this will further increase their cost of funds as, in the context of the existing card networks’ settlement, they will be paying out prior to receiving funds and having to fund interchange. This becomes even more costly as interest rates rise.

Regardless, RTP will be a vital solution for many merchants, especially in instances where its cost may be passed along. Payfacs should consider its potential in winning clients and building a brand to meet the coming demand.

Author: Ken Musante, Commercial Director, San Francisco, Payments Consulting Network

***

This article was originally published on the Green Sheet.

If you enjoyed reading this article and would like to be notified when future articles are posted, please sign up for our email newsletter.

Are you interested in reading articles on a particular payments topic, company, payments industry executive or author? Click the search icon, it’s that magnifying glass on the top right-hand side of the website, and type in the keywords that interest you. You will then be presented with a list of any articles that match your search criteria.