Payment System Evolution – Near Real Time Payments

Near Real-Time payments are becoming increasingly established globally with more than 50 countries have implemented this new payment method.

Near Real-Time (NRT) may also be referred to as Instant, Immediate, Faster etc. but the underlying premise is that regardless of the time of day or the day of the week, funds can be transferred, optimally within seconds.

NRT supports credit transactions initiated by the payer instructing their financial institution to debit their account and to credit another party (recipient/payee) account. It is often referred to as a peer-to-peer transaction. The parties can be individuals, businesses, government agencies, charities, etc. in all pairing combinations.

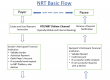

The above diagram illustrates the basic NRT flow.

If the recipient’s (payee’s) financial institution is not the same as the initiator’s (payer’s) financial institution the payment request will be sent to the NRT switch for forwarding to their institution. If accepted, the transaction will be settled in real-time as these payments are supported by non-repudiation. They cannot be reversed by the system. The NRT business rules must cover disputed transactions.

Commercial banks, which have an exchange settlement account with their Central Bank, are considered ‘Direct Participants’. Depending on the jurisdiction, non-financial institutions may also have an exchange settlement account and therefore be eligible. These settlement institutions may be large payment service providers, mobile money providers, prepaid services such as mass transit etc., under the supervision of the Central Bank.

Most implementations will support Indirect Participants where the institution has a settlement arrangement with a direct participant. Indirect participants should connect directly with the NRT switch, but the option to pass payment messages through their partnering participant institution is feasible.

REASONS FOR IMPLEMENTING A NRT PAYMENT METHOD

Immediacy

With the advancement of technology and its influence on individual lifestyles, societies have developed an expectation that tasks that have historically taken time will now be performed immediately. This expectation is impacting businesses, increasing the demand for immediacy in the overall commercial process of buying or selling products and services.

This also applies for person-to-person funds transfers.

Overlay Services

These are services that sit outside the NRT switch developed either by a financial institution or by third party providers (e.g. FinTechs). Overlays are normally integrated with the financial institutions’ mobile/internet banking application. Osko in Australia is an example of an overlay that allows bank customers to complete bank transfers between participating banks and financial institutions.

The most common overlay providers support users registering their mobile phone number and/or email address to link to their transaction bank account. If a user is not registered, the system will send a text or email message if a payment is received requesting the user to register.

PayTo is a New Payments Platform (NPP) overlay that started to be be rolled out from 30 June 2022.

PayTo’s primary use case is to replace the traditional direct debit transactions where an account holder provides a business with a mandate to debit their account, often referred to as a pull payment. In effect, PayTo turns direct debits upside down so they become a push transaction where the account holder is fully in control. This is achieved by utilising the ‘Request to Pay’ message type.

The payer is required through their financial institution’s mobile banking application or Internet banking site to set up an authority to allow the PayTo overlay to generate a direct credit based on account holder specified criteria. Examples of these criteria can be value range, day in the month and frequency. The account holder has the ability to suspend or cancel the authority at any time.

There is an upside for businesses in terms of receiving payments, assuming the criteria are satisfied in near real-time. There are likely to be fewer dishonours, possibly as the account holder is aware when the payment will be requested and the credit generated. The traditional direct debit services can take 2-3 days to be processed

Data

Businesses, particularly in the consumer sector have become hungry for data so their analytical processes can build customer purchasing and lifestyle profiles to gain a marketing advantage over their competitors.

Enhanced data, (compliance to ISO20022) will also allow the payment process to support the transfer of the contractual/procurement details, within the payment message for the payee to update their internal systems more efficiently and support the timing of delivering performance outcomes to management.

Stimulation of the Economy

There is a view that a country’s economy will grow if the velocity at which the funds circulate is increased to an optimal level. The goal of an NRT payment system must be to extend the reach of digital money transfer and ideally reduce the dependency on cash, or other traditional payment methods reducing the latency in the overall payment process.

All businesses regardless of size have a focus on their accounts receivable and the time it takes customers to pay.

Payer Control

This is an intangible reason but real for payers seeking greater control over their funds. The alternative in many cases is to use a card, credit or debit, where the payment is initiated by the payee and although the payer’s account is debited in real-time, the payee’s receipt of payment is often delayed. Cards are also more open to fraud.

IMPACT OF NNP/NRT IN AUSTRALIA

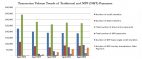

The following Chart illustrates the impact of the NPP (NRT) payment system on the Australian payment landscape.

The increase in NPP has slowed in the year ending April 2022 but it is still over 20%. This may be due to the impact of Covid-19 or simply because the entrenched traditional payments will take longer to transition. In fact, the year ending April 2021 saw an increase in Debit Transfers and Direct Entry Payments for a decline to reoccur in April 2022, although the decline was small.

NRT Capability of Dominating Payments

A new payment method requires a change in human behaviour that can only occur if there is a strong proposition covering convenience, cost and ease of use.

Debit cards have demonstrated that changing human behaviour is possible over an extended time period. This is especially demonstrated by NFC. When introduced, there was resistance primarily relating to security and the belief that proximity to a reader would result in unknowingly paying for somebody else’s purchase. Covid-19 reinforced the NFC proposition by removing the need to touch a device’s PIN pad and acceptance of the technology soared.

UK Finance in their paper, UK Payment 2019, are predicting that by 2024, debit card transactions will account for 50% of all UK’s payment transactions. This will be dependent on whether the introduction of enhanced and technology based delivery services to their NRT platform occurs or not.

NRT payments have demonstrated they are accepted as the method suitable for paying bills and as a replacement for cash in the one-off payment space.

However, if NRT is to challenge debit card payments it must be adapted for the retail payment market. The ‘Request for Payment’ transaction type has the potential to achieve this if the ‘points of acceptance’ platforms are developed to make this a frictionless process for retailers.

QR codes are an option with the buyer (payer) scanning a code, entering the transaction value and initiating the payment, with the merchant (payee) receiving a confirmation within seconds. Friction may still be an issue if performance expectations are not met and therefore the pay-off will be between increased time and potentially a lower fee.

If the fiction level is acceptable, the NRT proposition for retailers is strong as funds are immediately credited to their account. The card schemes will argue that cards carrying their brand offer consumer protection. However, there is no doubt that NRT at the point of sale would benefit both retailers and their customers. Retailers not only receive early payment, the customer would receive receipt details within the ISO20022 message, which should be accessible on their mobile phone or via a download using their Internet banking service.

For smaller merchants the ‘friction’ is possibly not an issue. Friction or the time it takes to complete the sale process is an issue for larger retailers such as supermarkets.

Cross Border Payments

Scheme cards are accepted for cross border payments and they will continue in the near future for e-commerce and international travel as the primary payment method. This is almost back to the future for cards as travel was part of their original cardholder proposition.

The international aspect of e-commerce restricts the payment methods in the immediate term to cards. It can be expected that as NRT goes cross border that card payments will be seriously under threat even in the ecommerce space.

What this all means is that for domestic payments, cards are likely to be adversely impacted by the adoption of NRT but will survive. Even though domestically card schemes have almost ignored the merchants proposition as they concentrated and competed for cardholders. They must revitalise the merchant proposition to encourage continued card acceptance. Taking a near real-time approach to card payments for merchants, with reduced fees may prove necessary.

PayU announced on 29 July 2021 a partnership with Visa covering push payments. This supports the view schemes see NRT as a threat.

NRT Cross Broader

There will be a network established to support NRT cross border payment. The following has been taken from the SWIFT website:

“SWIFT Go is a transformative new service that delivers exactly that. With SWIFT Go, financial institutions can enable their SME and retail customers to send predictable, fast, highly secure, and competitively priced low-value cross-border payments anywhere in the world, direct from their bank accounts.”

A group of banks are currently piloting this service. What will be interesting is if financial institutions (or their Central Banks) integrate this service with their domestic NRT service. Participants extending their Internet banking and/or mobile banking services so their customers have a single channel covering the full range of payment options to meet their money transfer requirements.

This type of payment service (cross border NRT) can support the introduction of a global digital currency where all international payments in such a currency are settled.

Author: Peter Goldfinch, Research Director, Australia, Payments Consulting Network

***

If you found this article helpful and would be interested in reading similar articles by our consulting team, please subscribe to our newsletter.

To get notified of our latest posts, follow Payments Consulting Network company LinkedIn page and click on the bell icon at the top right section of our company profile.