Has SoftPOS Been a Success in Europe So Far?

As digital payments grow, new technology can deliver new customer experiences. The frictionless checkout experience seen online is seeping into the physical retail world. SoftPOS is one technology leading the way in bringing new levels of innovation into the card present retail space. Juniper Research forecasts that global SoftPOS transaction values will grow with a CAGR of at least 53% over the next five years, and the European market for Mobile Point of Sale devices – including SoftPOS – will be worth $15 billion by 2027.

As digital payments grow, new technology can deliver new customer experiences. The frictionless checkout experience seen online is seeping into the physical retail world. SoftPOS is one technology leading the way in bringing new levels of innovation into the card present retail space. Juniper Research forecasts that global SoftPOS transaction values will grow with a CAGR of at least 53% over the next five years, and the European market for Mobile Point of Sale devices – including SoftPOS – will be worth $15 billion by 2027.

Introducing SoftPOS

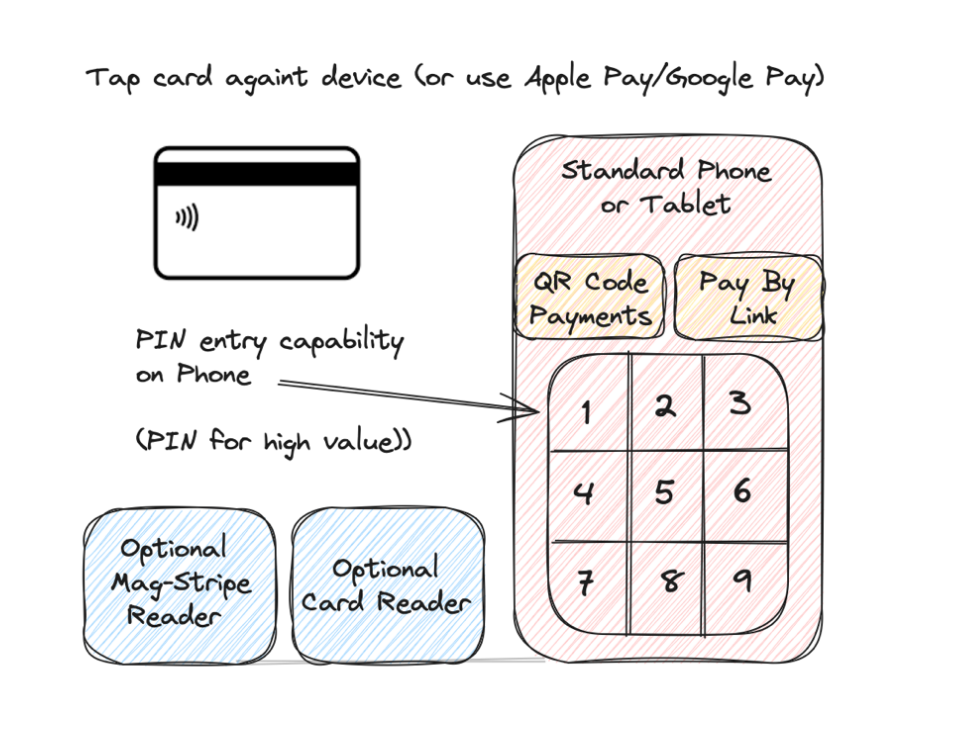

SoftPOS technology allows businesses to accept payments via a standard iOS or Android device. For the first time, a company can take in-person card payments without buying and maintaining payment-specific hardware. SoftPOS payments are only made via a contactless card, Apple Pay, or Google Pay. Markets with a high contactless penetration – cards issued or mobile wallets – will see the most success.

Unlike previous mobile payment solutions (often termed MPOS), the idea for SoftPOS was taking payments on an “off the shelf” device. A standard phone or tablet with NFC capability that a small business can easily buy in the high street can take card payments. In other words, a standard handset used for calls, emails and browsing can replace a POS machine. Payment acceptance becomes another application on the phone.

There are several key benefits that SoftPOS can provide to merchants, consumers, and even acquirers:

- Hardware agnostic – any device with an NFC capability can take payments, allowing flexibility for merchants of all sizes. For consumers who may have considered starting a part-time business. Device flexibility allows casual businesses to operate efficiently without upfront investment.

- New distribution channels – acquirers and other resellers of merchant solutions can distribute their offerings via mobile app stores. There’s no need to rely on selling POS devices to connect to processing services. App store software distribution means more payment acceptance endpoints, which can be scaled as needed.

- Speed to go live – with software-based payments, merchant onboarding can be seamless and paperless. There is no need to wait days or weeks to set up a merchant account, as onboarding should be fully digital. Electronic KYC (Know Your Customer) can enable businesses to make sales faster than ever.

Whilst still a nascent technology, SoftPOS grew significantly in 2023. Expect SoftPOS to go mainstream and become a standard sight in the years ahead, but there will undoubtedly be some growing pains. Let’s review the evolution of SoftPOS and its future direction. Specifically with Europe, including the UK, in mind.

The Certification Journey

Firstly, SoftPOS as a product has evolved over many years. A key regulatory body, the PCI SSC, has established the various operating frameworks for SoftPOS. (PCI SSC stands for the Payments Card Industry Security Standards Council.) As many who work in the payments industry will be aware, PCI compliance can be a crucial requirement. Banks especially, are security orientated. Indeed, all providers of payment products are keen to ensure that any solutions meet the highest security levels possible.

The PCI SSC has released various guides and iterations of the PCI operating framework in recent years. SPoC was the first in the spring of 2018, followed by CPoC at the end of 2019. MPoC is the latest framework, released to the public at the end of 2022. Each of these frameworks is iterative, with new capabilities added to each framework.

Finally, with MPoC, there’s a framework which allows SoftPOS to go to market with a full-scale solution. Before MPoC, card scheme waivers were required for the PIN capability. PIN entry on a mobile device was not in scope for SPoC or CPoC, but it is in scope for MPoC. Additionally, under MPoC, an SDK solution can be certified as PCI-compliant.

Previously, an SDK approach was outside of the PCI certification framework. Due to the demand for an SDK-based approach, Visa created an operating framework known as Visa 1.8. This interim approach helped launch some solutions with a Visa-certified SDK before the full MPoC standard was ready.

With an SDK approach, contactless payment acceptance can be embedded within any new or existing app. Embedded payments in action – take a payment when and where needed and augment existing user journeys. Without an SDK, SoftPOS will usually be in the form of a standalone app just to take payments. This approach may be acceptable for some use cases, but the market has been waiting for the flexibility and breadth that only an SDK can provide.

Use Cases and Opportunities

After briefly examining the certification requirements for SoftPOS, let’s look at the use cases for SoftPOS. Where has SoftPOS seen success so far? And what business segments have benefitted from its implementation?

Starting with Micro and Small Merchants, SoftPOS provides a low-cost payment acceptance option. A market stall trader can choose from a couple of different options. Use a device such as a Zettle card reader,or take the payments directly on their own device with SoftPOS. Zettle is actually one of the companies that have added SoftPOS functionality into their own app, as have Sum Up.

Businesses on the go, such as handymen and personal trainers, are great use cases for SoftPOS. Our mobile phone is the only device we always have on us. As well as providers such as PayPal owned Zettle, new entrants are targeting the small merchant segment in various countries. Businesses can only benefit from the increase in choice and competition.

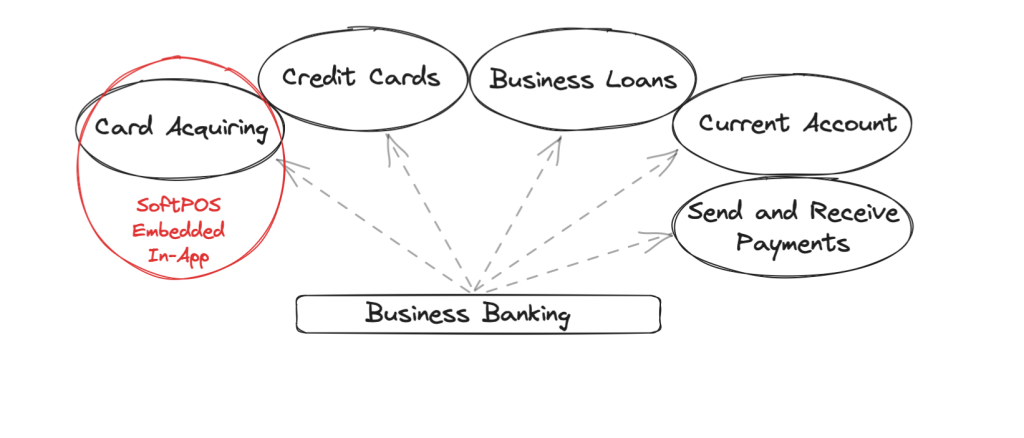

Banks (retail banks and neo-banks) make for an exciting SoftPOS use case. Traditionally, many card acquirers were also banks themselves. Payment providers such as Adyen and Stripe emerged in the past decades as a new wave of acquirers with an API and e-commerce focus. Now, SoftPOS plus an SDK opens up room for collaboration. Monzo, the UK’s biggest Neo-bank (app-only bank), has 9 million personal account customers and hundreds of thousands of business bank users. Monzo has collaborated with Stripe to launch SoftPOS directly within their mobile banking app. Users can check incoming payments one moment and then accept a SoftPOS payment from a client the next, all within the same banking app.

With SoftPOS, every bank can become a payment company. They can offer payment acceptance directly from their existing mobile banking app. Like Monzo, Revolut has also launched SoftPOS in the UK. OTP Bank in Hungary, and various banks in the Intesa Sanpaolo group have also gone to market with their solutions. Adding SoftPOS to a mobile banking app will also be an obvious choice for many other banks. Banks already know their customers. Funds for any payments taken via SoftPOS can be deposited straight into their existing bank account. What’s not to like?

Enterprise (large retail) is a use case just starting its SoftPOS journey. As mentioned earlier, SoftPOS was initially targeted at so-called “off the shelf” devices. Over time, broader use cases have become clear. Payment providers and large businesses like the fact that with SoftPOS, any app can have contactless payments added. If using SoftPOS on non “off the shelf” devices, some extra certification is needed to go to market, albeit this is manageable.

Companies utilising SoftPOS for enterprise-level use cases include Honeywell and Zebra. Previously, these companies have not made payment-specific devices. With SoftPOS payment capability, they can add NFC to their devices and create new use cases that include payments. One such use case is delivery companies. SoftPOS can be used for payment upon delivery; in some markets, this is the preferred way to pay for delivery services.

Devices traditionally used for inventory and stock keeping may now also have NFC included. This hardware upgrade means that staff placing products on shelves can also take payments wherever they are in the store. SoftPOS can enhance the customer experience. There’s no reason to send customers to join a queue when you check out anywhere.

These examples show many varied use cases, but SoftPOS is not an all-or-nothing technology. For some organisations, SoftPOS will be used – at least initially – as a complementary solution. For instance, SoftPOS can be a backup solution for when an existing terminal is out of action and needs to be replaced. Or suppose a payment processor has an outage. In that case, a SoftPOS solution connected to an alternative provider can ensure that a business retains the capacity to accept payments from customers with no downtime.

One Part of the Payments Innovation Jigsaw

In considering whether SoftPOS has succeeded in Europe so far, there are a couple of ways to answer this question. Firstly, SoftPOS has taken longer than expected to reach the expected user base. We can measure this by the number of devices or the number of transactions so far. However, this delay has partly been due to the market waiting for the regulation to reach the right place. Now that the MPoC regulation is in the market and a PCI-certified SDK is a reality, many companies are proceeding full steam ahead in launching SoftPOS in 2024 and 2025.

Secondly, SoftPOS technology is continuing to develop in numerous ways. In the summer of 2023, Apple launched SoftPOS on iOS in selected markets. Officially known as Tap to Pay on iPhone, markets live include the UK, France and the Netherlands, with more to follow soon. Currently, the iOS NFC capability can only be utilised via Apple’s own approved route to market with a direct integration. In the future, more options may be available to utilise Apple’s NFC capability. This is a positive step forward, as markets with a high share of iOS users will now be better placed to offer to embrace SoftPOS.

Lastly, SoftPOS is not simply a contactless payment driven by an app but an option within a wider payment proposition. For instance, the same app that offers SoftPOS can offer QR Code payments and instalment payments. SoftPOS devices can even link to a wider cash register system. Additionally, MPoC allows SoftPOS to be more than just a contactless payment on a standard device. A business can link an additional card reader to a SoftPOS app via Bluetooth for extra flexibility. Altogether, SoftPOS can provide a wide array of payment possibilities in a compliant and secure way.

Looking to the future, SoftPOS will be an important in enabling frictionless payments in a card-present environment. Small businesses will find it easier to set up merchant accounts and begin processing payments quicker than ever. Acquirers, PSPs, and ISOs will invest in automated onboarding solutions. Payment processors who are mobile first will find it easier to win new merchants. Contactless payments will grow as a share of total card transactions, whether via card or mobile wallet. Juniper Research estimates that globally, more than 34 million smartphones will be used as POS devices by 2027, an estimate which may be on the conservative side if SoftPOS really does take off.

Author: Matt Jones, Commercial Director, London, Payments Consulting Network

With over 15 years in the payments industry, Matt has worked with notable organisations like Barclays and Elavon, as well as startups in the fintech space. His expertise spans diverse commercial sectors, including direct engagements with major merchants and banks. Matt excels in procurement-level insights, adeptly handling pricing models, strategic planning, and competitive analysis.

***

If you found this article helpful and would like to read similar articles, please subscribe to our newsletter.

To get notified of our latest posts, follow the Payments Consulting Network company LinkedIn page and click on the bell icon at the top right section of our company profile.